2025 Fraud Investigation Benchmark Report on Corporate Readiness

Inside the Numbers: What the 2025 Fraud Investigation Benchmark Report Reveals About Corporate Readiness

Fraud investigation is no longer a niche discipline — it’s an essential business function.

The 2025 In-House Fraud Investigation Teams Benchmarking Report from the Association of Certified Fraud Examiners (ACFE) paints a revealing picture of how organizations are approaching fraud risk in an era of complex financial systems, remote operations, and constrained resources.

At Turning Numbers, we work alongside legal counsel, boards, and internal audit teams to identify, investigate, and prevent financial misconduct. This report’s data confirms what we see in the field every day: most companies are under-resourced and underprepared to respond effectively when fraud occurs.

Let’s unpack the findings — and explore what they mean for your organization’s fraud prevention strategy.

1. Limited Resources, Growing Exposure

One of the most striking statistics:

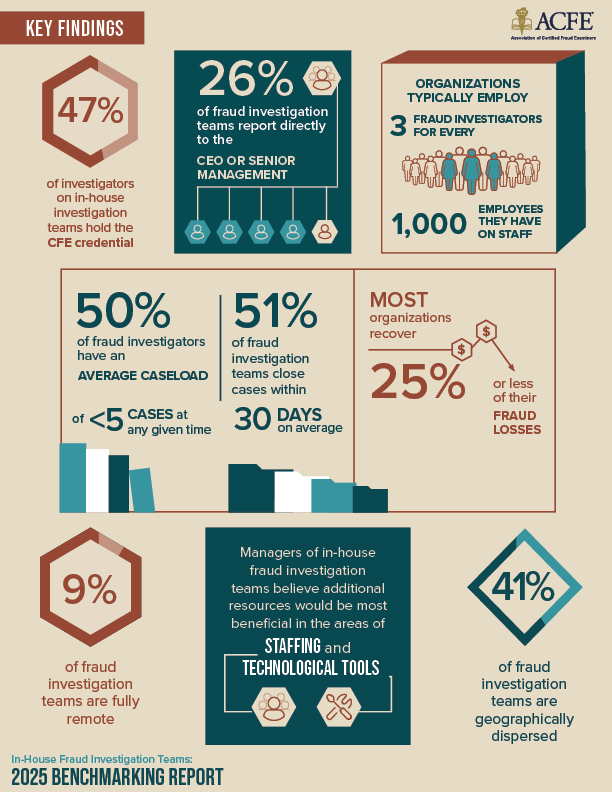

Organizations typically employ just 3 fraud investigators for every 1,000 employees.

That ratio might seem sufficient until you consider the scope of modern fraud risk — financial reporting manipulation, vendor kickbacks, payroll fraud, cyber-related embezzlement, and more. With limited staff, investigation teams face a difficult balancing act between reactive case management and proactive prevention.

At Turning Numbers, we routinely supplement internal teams during investigations that exceed capacity. When fraud touches multiple departments or involves senior leadership, objectivity and experience become critical. Independent forensic accountants bring the clarity and independence internal staff can’t always provide.

2. Leadership Oversight is Uneven

Only 26% of in-house fraud investigation teams report directly to the CEO or senior management.

That means nearly three-quarters of fraud investigations are filtered through layers of management before reaching leadership — a delay that can hinder transparency and accountability.

Turning Numbers Insight:

Reporting structure matters. Fraud investigation teams that report directly to top leadership or an audit committee are far more effective. When investigations are buried under HR or compliance silos, findings may be minimized or politically constrained.

Our forensic accountants often serve as independent liaisons between internal teams and executive leadership, providing factual, defensible findings that guide next steps — including disciplinary action, prosecution, or process redesign.

3. Speed vs. Substance: The 30-Day Resolution Trap

The report shows that 51% of fraud investigation teams close cases within 30 days.

At first glance, that looks efficient. But many frauds — particularly those involving financial statement manipulation or multi-year embezzlement — require far longer to unravel. Rapid case closure can reflect resource constraints rather than thoroughness.

Turning Numbers Insight:

Speed should never come at the expense of completeness. A 30-day turnaround might resolve minor employee theft but can overlook deep-rooted control failures or collusion.

Our forensic methodology focuses on

evidence integrity, pattern tracing, and data reconstruction, ensuring conclusions are defensible in court and audit-ready — not just “case closed.”

4. Caseloads Are Manageable, But Depth Varies

Roughly

half of fraud investigators manage fewer than five cases at a time.

That suggests that most internal teams are small and work reactively, not proactively.

While a light caseload might indicate control strength, it often means that investigations are handled piecemeal, without systemic review or enterprise-wide pattern analysis. Fraud is rarely isolated; it thrives in the same weak spots year after year.

Turning Numbers helps companies look beyond the case — conducting trend analysis across vendors, expense reports, and financial statements to reveal root causes and prevent repeat offenses.

5. Recovery Rates Remain Low

Perhaps the most sobering finding:

Most organizations recover 25% or less of their fraud losses.

Even with internal investigations, recovery remains elusive. Once assets are misappropriated or records falsified, tracing and restitution become difficult — especially when fraud has gone undetected for months or years.

Turning Numbers Insight:

Independent forensic accountants can significantly improve recovery outcomes. By combining data analytics with legal coordination, we help clients document loss valuation, pursue restitution, and support litigation through expert witness testimony.

Every dollar recovered starts with accurate, defensible quantification — a core function of forensic accounting.

6. Resource Gaps: Staffing and Technology

Managers of in-house investigation teams cite staffing and technological tools as their biggest needs.

And for good reason. Fraud today leaves a digital trail — across ERP systems, bank feeds, communications, and approval workflows. Without the right forensic technology, critical data can remain hidden in plain sight.

At Turning Numbers, we leverage digital forensics, transaction testing, and continuous monitoring analytics to uncover concealed activity. For smaller or mid-market companies without dedicated tools, partnering with a forensic firm can deliver the equivalent of a fully equipped internal investigation team — without the overhead.

7. The Remote and Dispersed Reality

The ACFE found that:

- 9% of fraud investigation teams are fully remote.

- 41% are geographically dispersed.

Remote oversight increases risk — particularly for companies relying on decentralized systems or distributed accounting functions. Communication lags, inconsistent data access, and jurisdictional limits can all slow investigations.

Turning Numbers Insight:

Geography shouldn’t limit accountability. Our forensic accountants conduct hybrid and remote investigations using secure digital evidence collection, ensuring accuracy and compliance no matter where the data resides.

8. The Credential Gap

Only 47% of investigators on in-house teams hold the Certified Fraud Examiner (CFE) credential.

While credentials don’t guarantee quality, they indicate a professional foundation in fraud detection, interviewing, digital forensics, and litigation support. When half of investigators lack this training, cases risk being handled inconsistently — or defensibly challenged later.

Turning Numbers Insight:

All Turning Numbers forensic accountants and fraud specialists operate under rigorous professional standards, ensuring that our findings hold up in regulatory review, arbitration, and court testimony. Experience and accreditation matter — especially when the stakes are high.

9. Key Takeaway: Most Teams Need Reinforcement, Not Replacement

The report doesn’t suggest that companies should abandon internal fraud teams — but it does underscore their limitations.

The most effective organizations supplement internal resources with external forensic experts who can:

- Investigate high-risk or politically sensitive cases.

- Provide unbiased documentation for insurance or litigation.

- Strengthen fraud detection through data-driven analytics.

- Train internal staff to recognize behavioral and transactional red flags.

Fraud doesn’t just test financial systems; it tests an organization’s integrity. Combining internal diligence with external expertise is the best defense.

The Turning Numbers Advantage

At Turning Numbers, we bring independence, experience, and evidence to every engagement. Whether you’re responding to an active fraud allegation or building a prevention framework, our team delivers:

- Fraud Investigation & Forensic Audits

- Litigation Support & Expert Witness Testimony

- Internal Control & Risk Assessments

- Digital Forensics & Data Analytics

Every case tells a story — our job is to find the truth within it.

Contact Turning Numbers for a confidential meeting to discuss your concerns.