Behavioral Red Flags of Fraud: Essential Warning Signs for Your Fraud Prevention Program

Fraud rarely begins with spreadsheets — it begins with behavior.

While financial data can reveal what happened, a person’s actions often signal

when and

why it’s about to happen.

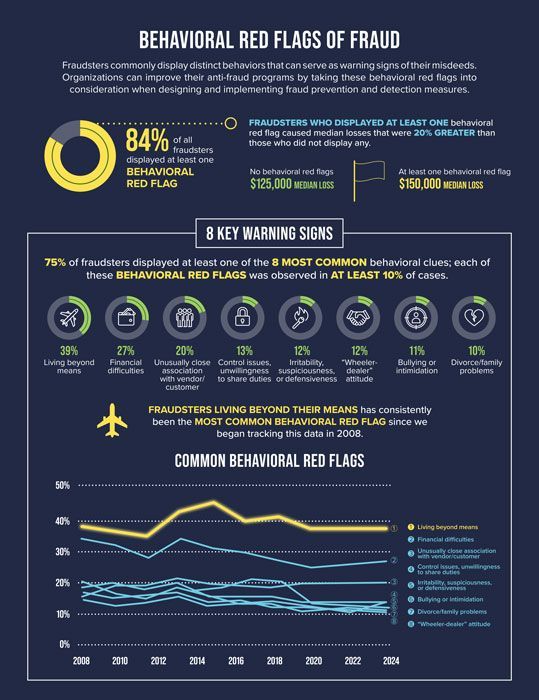

According to the latest data presented in the “Behavioral Red Flags of Fraud” infographic, 84% of all fraudsters displayed at least one behavioral warning sign before their scheme was uncovered. These patterns are not just coincidences; they’re consistent predictors that, when ignored, can cost organizations hundreds of thousands — or even millions — of dollars.

At Turning Numbers, our forensic accounting experts investigate these warning signs every day. From embezzlement and corruption to financial statement manipulation, behavioral analysis is often the first clue that leads us to uncover the numbers behind the narrative.

Below, we explore the key findings from the data — and what they mean for business owners, boards, and compliance professionals striving to prevent fraud before it’s too late.

1. Behavior Predicts Risk: 84% of Fraudsters Showed Red Flags

The data is clear:

- 84% of all fraudsters displayed at least one behavioral red flag

- Those individuals caused median losses 20% higher than those who showed none

| Behavioral Clue | Median Loss |

|---|---|

| No red flags | $125,000 |

| At least 1 Red Flag | $150,000 |

These are not trivial differences. Fraudsters who display recognizable patterns of stress, secrecy, or overconfidence often create the most financial damage — because they go unchecked for longer.

Turning Numbers Insight:

Our

forensic accountants use behavioral indicators alongside data analytics to flag anomalies early. In many cases, suspicious behavior — reluctance to share duties, unexplained lifestyle changes, or defensiveness under scrutiny — precedes the discovery of fraudulent transactions.

2. The Eight Most Common Behavioral Red Flags

The infographic identifies eight recurring behavioral clues that appear in at least 10% of all fraud cases:

- Living beyond means

- Financial difficulties

- Unusually close association with a vendor or customer

- Control issues or unwillingness to share duties

- Irritability, suspiciousness, or defensiveness

- “Wheeler-dealer” attitude

- Bullying or intimidation

- Divorce or family problems

Three out of every four fraudsters (75%) displayed one or more of these top eight red flags.

Most Common:

“Living beyond means” has remained the number-one behavioral red flag since 2008 — and for good reason. Sudden lifestyle upgrades often signal personal financial strain or rationalized misuse of company funds.

Turning Numbers Insight:

Fraud prevention isn’t about judgment; it’s about observation. When lifestyle changes don’t align with income or role, forensic accountants see it as a risk factor — not proof of guilt, but a signal to review financial controls more closely.

3. High-Risk Behaviors Linked to the Highest Losses

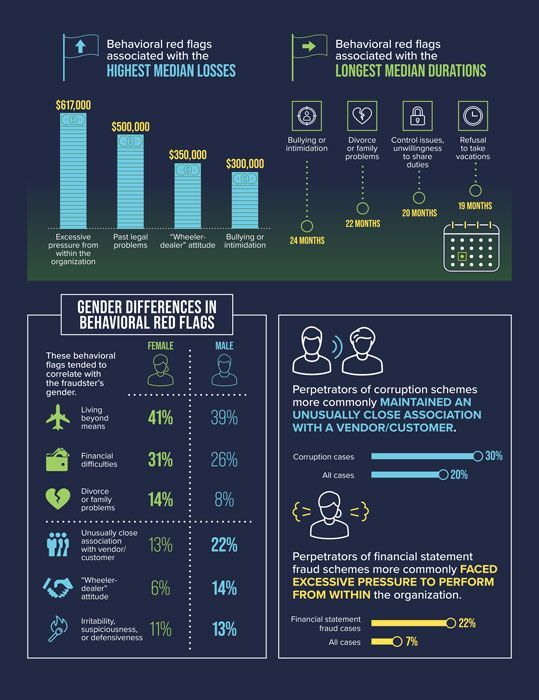

Certain behavioral traits correlate with significantly greater financial impact.

The infographic highlights the following red flags associated with the

highest median losses:

| Behavioral Red Flag | Median Loss |

|---|---|

| Excessive pressure from within the organization | $617,000 |

| Past legal problems | $350,000 |

| Bullying or intimidation | $300,000 |

Turning Numbers Insight:

High-pressure environments — where employees are pushed to “make the numbers work” — can turn ambition into rationalization. Fraud isn’t always driven by greed; sometimes it’s survival under unrealistic expectations.

At Turning Numbers, our forensic experts often identify organizational culture as a hidden enabler. Performance pressure without oversight is a breeding ground for manipulation of financial statements, especially in executive roles.

4. Behavioral Red Flags and Duration: How Long Fraud Lasts

Some behaviors don’t just predict higher losses — they also predict

longer-lasting schemes. The data shows that these red flags correlate with the

longest median durations of undetected fraud:

| Red Flag | Duration |

|---|---|

| Bullying or intimidation | 24 months |

| Divorce or family problems | 22 months |

| Control issues, unwillingness to share duties | 20 months |

| Refusal to take vacations | 19 months |

Fraudsters who intimidate colleagues or isolate themselves from oversight can sustain their schemes for years.

Turning Numbers Insight:

Mandatory vacations, job rotation, and dual approvals are simple, powerful deterrents. When no one else ever touches the books or accesses a system, the organization loses visibility — and the fraudster gains time.

5. Gender Differences in Behavioral Patterns

Behavioral red flags can also show subtle gender trends:

| Behavioral Indicator | Female | Male |

|---|---|---|

| Living beyond means | 41% | 39% |

| Financial difficulties | 31% | 26% |

| Divorce/family problems | 14% | 8% |

| Unusually close vendor association | 13% | 22% |

| “Wheeler-dealer” attitude | 6% | 14% |

| Irritability or defensiveness | 11% | 13% |

While the differences are modest, they emphasize that behavioral red flags manifest differently across individuals. No single demographic predicts fraud; rather, it’s the convergence of stress, opportunity, and rationalization that creates the perfect storm.

6. Fraud Type Correlations: Where the Pressure Comes From

Different types of fraud carry distinct behavioral markers:

- Financial statement fraud: Most perpetrators face

excessive pressure from within the organization — often tied to performance goals or investor expectations.

- Corruption schemes: Perpetrators more often maintain an

unusually close relationship with vendors or customers, enabling conflicts of interest and kickbacks.

Turning Numbers Insight:

Forensic accountants assess both numbers and narratives. A manager under intense internal pressure or maintaining exclusive vendor relationships deserves objective scrutiny — not suspicion, but structure. The goal is prevention through transparency.

7. Recognizing Patterns, Not People

One of the most important takeaways from the Behavioral Red Flags of Fraud study is that these indicators are not accusations — they’re patterns of concern.

Fraud detection depends on systems designed to respond to behavioral data as much as financial data. When Turning Numbers conducts fraud risk assessments, we integrate behavioral risk scoring into forensic reviews, combining:

- Transaction analysis

- Control testing

- Behavioral and environmental factors

- Interviews and digital forensics

This holistic approach allows us to identify early-warning signs before they evolve into systemic loss.

8. From Awareness to Action

Behavioral red flags are powerful indicators, but they only work if someone’s looking for them.

What organizations can do:

- Train managers and HR staff to recognize stress-based or defensive behavior patterns.

- Cross-reference behavioral observations with financial or control data.

- Establish anonymous reporting channels.

- Enforce job rotation and mandatory time off for sensitive roles.

- Engage forensic accounting experts for independent assessments.

The earlier you detect a behavioral red flag, the lower the financial loss — and the greater the chance of preserving organizational trust.

Turning Numbers: Seeing Beyond the Numbers

At Turning Numbers, we believe every fraud investigation tells a human story. Behind every spreadsheet, there’s pressure, opportunity, and a moment of rationalization. Our role is to bring clarity — and evidence — to those moments.

Whether your organization faces an active fraud concern or simply wants to strengthen internal defenses, our team of

forensic accountants, fraud investigators, and expert witnesses can help you build a resilient, ethical, and transparent financial culture.