Profile of a Fraudster: Insights from Forensic Accounting Experts

The Profile of a Fraudster: What Every Business Needs to Know

By Turning Numbers, Inc. | Forensic Accounting Firm • Fraud Investigation • Litigation Support

When fraud strikes, it rarely comes from where you expect. At Turning Numbers, our forensic accountants have seen it all—trusted managers siphoning funds through subtle manipulations, long-tenured employees exploiting overlooked controls, even executives rationalizing misappropriation as “temporary borrowing.”

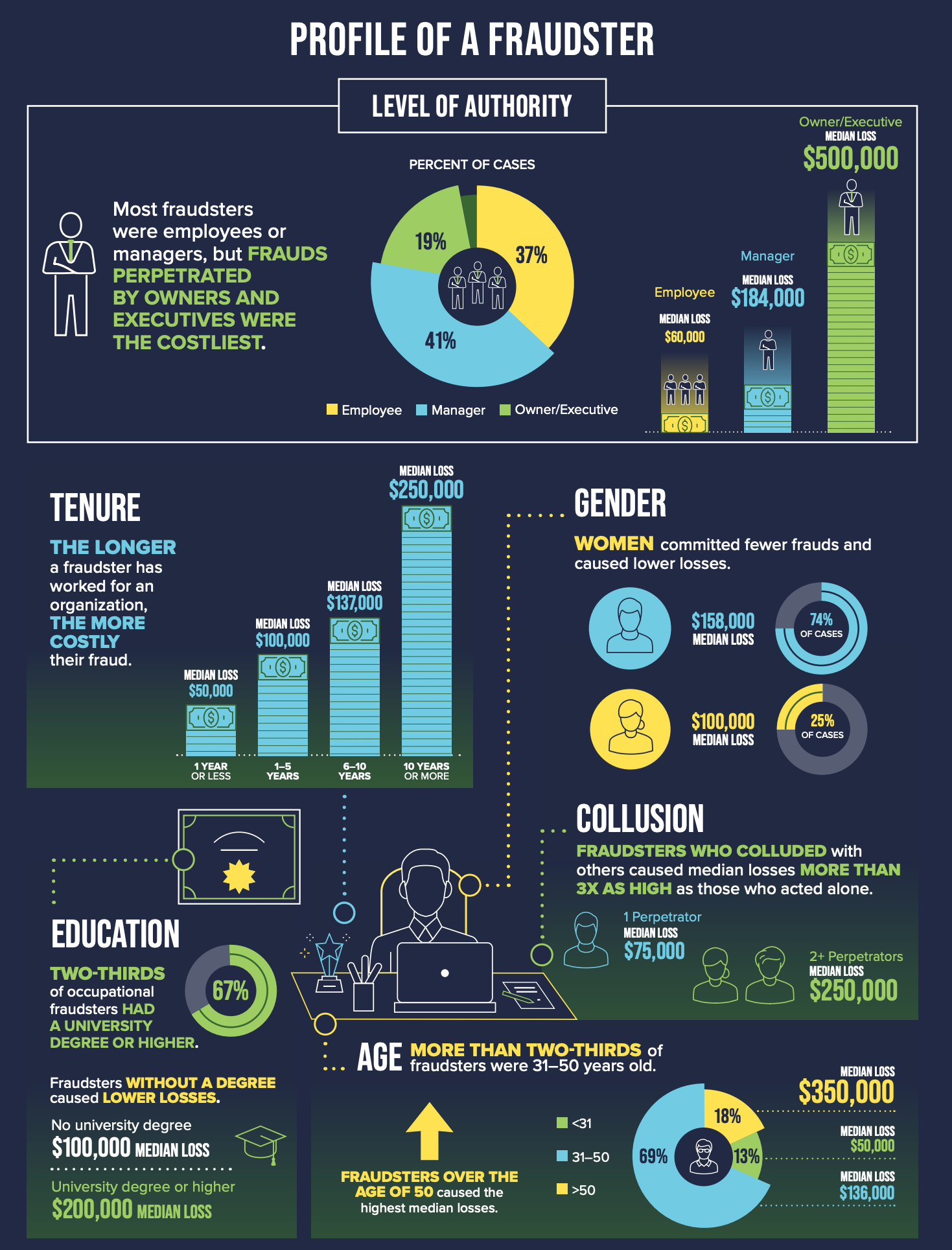

A recent analysis, captured in the “Profile of a Fraudster”infographic, paints a striking portrait of who commits fraud, how they operate, and why their schemes succeed. Understanding this profile is one of the most effective ways to detect, prevent, and respond to occupational fraud before it escalates into a costly crisis.

Below, we unpack the data through the lens of our forensic experience—highlighting the hidden patterns and actionable lessons that every organization should take seriously.

1. Tenure: Trust and Time Can Be Risk Factors

One of the most revealing insights is that the longer a fraudster has worked for an organization, the more costly their scheme tends to be.

| Tenure | Median Loss |

|---|---|

| 1 year or less | $50,000 |

| 1–5 years | $100,000 |

| 6–10 years | $137,000 |

| 10 years or more | $250,000 |

At Turning Numbers, we see this pattern repeatedly during forensic audits. Long-tenured employees often gain deep institutional trust, broad access to systems, and an understanding of how internal controls operate—and where they’re weakest. That combination creates the perfect environment for concealment.

What it means for businesses:

- Rotate duties periodically, even for veteran employees

- Require mandatory vacations for staff in key financial roles.

- Conduct independent reviews of long-term employees with access to cash, billing, or reporting.

- Fraud prevention isn’t about distrust—it’s about intelligent oversight.

2. Authority Level: The Higher the Rank, the Higher the Loss

While

most fraudsters are employees (41%) or managers (37%), the

frauds perpetrated by owners and executives (19%) are the costliest by far.

| Role | Median Loss |

|---|---|

| Employee | $60,000 |

| Manager | $184,000 |

| Owner/Executive | 500,000 |

When the person at the top manipulates financial statements, approves fictitious vendors, or overrides controls, the resulting losses can devastate a company. Internal checks often fail because employees hesitate to question authority.

At Turning Numbers, our forensic accountants often serve as independent investigators in these high-stakes cases, providing boards and legal counsel with objective, data-driven evidence.

What it means for businesses:

- Create oversight structures that hold senior leadership accountable.

- Establish direct reporting lines from finance and audit to the board.

- Enforce segregation of duties—even at the executive level.

3. Collusion: Fraud Grows with Company

Fraudsters who act alone cause a median loss of $75,000, while those who collude cause losses exceeding $250,000—more than three times higher.

Collusion makes detection exponentially harder. When two or more individuals coordinate to falsify approvals or share credentials, traditional red flags often disappear.

Turning Numbers uses data analytics and digital forensics to identify unusual transaction patterns across departments and users. Technology helps reveal what teamwork conceals.

What it means for businesses:

- Cross-match vendor, payroll, and approval data regularly.

- Monitor for shared access credentials or duplicate approvals.

- Protect whistleblowers—insiders often see what auditors can’t.

4. Education and Opportunity

Nearly two-thirds of occupational fraudsters hold a university degree or higher, and those individuals cause significantly higher losses.

| Education | Median Loss |

|---|---|

| No degree | $100,000 |

| University degree or higher | $200,000 |

This challenges the assumption that education equates to integrity. Higher education often brings greater technical ability and confidence in manipulating data.

What it means for businesses:

- Don’t equate credentials with ethics.

- Layer your internal controls and audit trails.

- Require dual authorization for major financial transfers or system access changes.

5. Gender and Age: Subtle Trends, Big Implications

The infographic shows that women commit fewer frauds and cause lower losses, while men are responsible for the majority of cases and higher losses.

Age also plays a role:

| Age | Median Loss | % of Cases |

|---|---|---|

| Under 31 | $50,000 | 13% |

| 31-50 | $136,000 | 69% |

| Over 50 | $380,000 | 18% |

Experience, authority, and access—not youth—drive the size and impact of fraud. Senior staff often control larger financial levers and face greater temptation or rationalization.

What it means for businesses:

- Integrate behavioral analytics into fraud risk assessments.

- Pair mentorship with accountability.

- Refresh ethics and compliance training across all levels.

6. The Cost of Trust—and the Value of Verification

Fraud doesn’t just drain funds; it erodes reputation and morale. The data shows that trust without verification is one of the costliest mistakes organizations make.

When Turning Numbers conducts a forensic audit or fraud investigation, we look beyond the numbers to determine:

- Who had the opportunity?

- What controls failed?

- When did the warning signs first appear?

- Why did it continue undetected?

Our investigations often serve as key evidence in litigation and expert witness testimony, helping clients pursue restitution and strengthen future controls.

7. From Detection to Prevention: A Proactive Forensic Mindset

The “Profile of a Fraudster” isn’t just about who commits fraud—it’s about how organizations can stop it before it starts.

Top prevention steps from our forensic team:

- Conduct regular fraud risk assessments.

- Enforce segregation of duties across all financial processes.

- Create safe, anonymous reporting channels.

- Use data analytics for continuous transaction monitoring.

- Engage independent forensic accountants for system audits.

Fraud prevention isn’t a checklist—it’s a culture of vigilance.

8. Why Forensic Accounting Matters

Forensic accounting isn’t only about identifying what went wrong—it’s about protecting what’s right.

Turning Numbers combines investigative rigor with financial expertise to uncover the truth behind the figures. We partner with:

- Corporations and nonprofits facing suspected fraud or embezzlement.

- Law firms needing clear, defensible expert analysis.

- Boards and investors seeking confidence in internal controls.

From tracing hidden assets to providing expert witness testimony, we transform complex financial data into clarity and credibility.

9. Know the Numbers Behind the Faces

The “Profile of a Fraudster” reminds us that fraud rarely wears a mask—it hides in plain sight. At Turning Numbers, we help clients see behind the numbers, identifying patterns before they become losses.

If you suspect financial misconduct—or want to strengthen your organization’s defenses—contact our team for a confidential forensic review.