Forensic Accounting Services: Protecting Your Organization with Proven Expertise

When financial questions arise, having the right expertise on your side can protect your business reputation and bottom line. Forensic accounting services help organizations detect fraud, resolve disputes, and address suspicious discrepancies. These specialized services combine the skills of accounting and investigative techniques to get clear, accurate answers about your financial data.

Maintaining financial integrity is essential for every organization. Reliable records and transparent processes build trust with clients, partners, and stakeholders. Outsourcing forensic accounting lets you act quickly if concerns surface, without the expense of hiring a full-time expert.

If you want to strengthen your financial controls, guard against fraud, or need help with a sensitive internal investigation, professional support can make all the difference. Call us or fill out our form today to schedule a forensic consultation. To learn more about our fraud investigation services and how they can safeguard your organization, visit our page on forensic accounting expertise.

What Are Forensic Accounting Services?

Forensic accounting services provide much more than number crunching. These services are a blend of advanced accounting skills and investigative expertise. Organizations rely on forensic accountants when they suspect fraud, need to resolve business disputes, or must investigate financial records for potential legal action. The result is clear, defensible financial analysis designed to uncover the facts and protect your business.

Photo by Leeloo The First

Defining Forensic Accounting Services

Forensic accounting services use accounting, auditing, and investigative skills to examine financial records . These services play a key role when an organization faces accusations, litigation, or complex disagreements involving finances. Whether it's tracking hidden assets, uncovering fraudulent billing, or analyzing data for financial discrepancies, forensic accountants step in to find the evidence.

According to Investopedia , forensic accounting applies accounting and investigative techniques when the reliability of financial information is called into question, especially for legal cases. These specialists often work side-by-side with attorneys, insurers, and business owners to present their findings in court or negotiation settings.

Why Organizations Need Forensic Accounting

Not all financial matters are straightforward. In fast-paced environments, even small errors can cascade into bigger issues. Forensic accounting services help by:

- Detecting fraud and embezzlement: Identify suspicious transactions and patterns that signal theft or abuse.

- Supporting legal cases: Provide analysis and expert testimony to back up claims in lawsuits or regulatory investigations.

- Resolving partner or shareholder disputes: Clarify financial facts so decision makers can reach fair settlements.

- Investigating insurance claims: Help insurers and policyholders resolve disputes about losses and coverage.

Forensic accounting matters for any organization where money is at stake. These services are trusted in industries from manufacturing to nonprofits, as demonstrated by our industry-specific services.

Types of Forensic Accounting Services

Forensic accountants offer a wide range of services. Here are some of the most common examples:

- Fraud detection and prevention

- Asset tracing and recovery

- Financial statement analysis

- Internal investigations

- Litigation support and expert witness services

- Insurance claims assessments

- Royalty and contract compliance auditing

The scope of work often extends beyond surface-level spreadsheets. By piecing together trails of financial activity, a forensic accountant reveals what really happened—and documents every step.

When to Contact a Forensic Accountant

If your organization suspects misconduct, faces a financial dispute, or just wants to strengthen financial controls, forensic accounting services are a smart investment. Even if there is only a hint of fraud, acting quickly makes all the difference. These experts know how to preserve evidence and minimize costly mistakes during sensitive situations.

Want to learn more about how forensic accounting can protect your exact type of organization? Visit our resources for nonprofit financial management or our deep dive into manufacturing business insights.

For professional advice tailored to your situation, call us or use our online form to schedule a confidential forensic consultation.

How Forensic Accountants Help Organizations

Strong oversight is key to maintaining the trust and financial stability of any organization. Forensic accounting services play a direct role in rooting out misconduct, enforcing compliance, and helping leadership make informed decisions in high-stakes situations. These services go beyond traditional audits by revealing financial activity that might otherwise remain hidden. Real-world case studies show exactly how these specialized skills protect different types of organizations when it matters most.

Case Study: Manufacturing Sector

Manufacturing companies often handle large inventories, complex supply chains, and multiple vendors, which can create opportunities for fraud or costly errors. Imagine a mid-sized parts manufacturer where financial reports suddenly showed consistent year-end losses despite steady sales growth. Leadership suspected some type of internal problem but couldn’t pinpoint the source.

A forensic accountant was brought in to analyze accounting records, supplier contracts, and inventory data. By tracing the flow of goods and payments, the investigation uncovered a pattern: a trusted manager was creating fake purchase orders and diverting inventory to a side business. The forensic accountant’s detailed findings stopped the losses and supported legal action to recover stolen assets.

This scenario highlights how a targeted review by an expert can reveal fraud where regular audits miss the signs. If you’re in the manufacturing field, finding issues early can be the difference between a temporary setback and major financial harm. To learn more about tailored forensic services, check out these manufacturing industry solutions designed to address sector-specific challenges.

Case Study: Nonprofit Sector

Nonprofit organizations operate under the close watch of donors, grantmakers, and regulators. Even a minor compliance problem can threaten funding or damage public trust. Let’s say a regional nonprofit began receiving questions from donors about how funds were allocated and whether their donations were being spent correctly. Leadership started noticing discrepancies in reporting, but lacked the resources to carry out an internal review.

A forensic accounting team stepped in to conduct a thorough assessment of financial controls, grant compliance, and donation tracking. The accountants traced irregularities to a breakdown in expense documentation and a staff member redirecting restricted funds for unrelated projects. With a clear trail of evidence, the nonprofit could resolve compliance concerns, strengthen its internal processes, and restore donor confidence.

For organizations that rely on public trust, quick action is critical. Forensic accountants provide detailed analysis, help prevent future issues, and support transparent communication with funders. For a closer look at how this works in practice, see a discussion of the effect of fraud on nonprofit organizations , including common risk factors and prevention strategies.

What to Expect When You Hire Forensic Accounting Services

Hiring forensic accounting services goes beyond just getting help with suspicious transactions or missing funds. It's about bringing in expertise designed to shine a light on complex financial questions and provide trustworthy answers. You gain a professional team that examines your records with precision, documents the process, and delivers findings you can use when stakes are high. Here’s what you can expect once you make the call for help.

Photo by RDNE Stock project

The Initial Consultation and Engagement

When you first reach out for forensic accounting services, the process starts with an intake meeting. Here, you’ll discuss your concerns, business details, and what led you to seek help. This meeting is confidential and often sets the scope for what the investigation will cover.

A clear engagement letter follows. It lays out the objectives, methods to be used, deliverables, and expected timelines. Reliable firms ensure you know the boundaries of the service, the types of analysis to be performed, and the reporting procedures from the start. This commitment to transparency helps build immediate trust.

Detailed Investigation and Data Gathering

Once you sign the agreement, the forensic accountants get to work. They collect and review your financial records, bank statements, contracts, emails, and correspondence. You’ll see an emphasis on accuracy and documentation. Forensic accountants do not just sample data like routine auditors; they follow every lead that could reveal facts relevant to your case.

Expect professionals to:

- Conduct interviews with your staff or relevant third parties.

- Collect electronic and paper trail evidence for potential use in court.

- Map transaction flows to uncover inconsistencies or hidden assets.

Every step in this phase is methodical and documented, which is essential if you later need to pursue restitution, report misconduct, or explain the findings to other stakeholders.

For more about financial leadership during critical times, take a look at fractional CFO services as a flexible support option alongside forensic work.

Thorough Analysis and Expert Insight

The core of forensic accounting services is the detailed analysis. Here, specialists reconstruct transactions, trace funds, and spot irregularities other eyes might miss. This is where their experience with fraud detection, asset tracing, and compliance comes into play.

What you receive:

- A clear summary of findings in plain language (not jargon).

- Well-prepared, defensible reports with evidence trails.

- Professional recommendations backed by facts, not guesses.

Forensic accountants know you need more than numbers; you want clarity, confidence, and a path forward.

Communication and Updates

You won’t be in the dark during the engagement. Expect scheduled updates, clear timelines for deliverables, and open lines of communication if you have questions or new information. The process involves your leadership team at each major step, ensuring alignment and transparency.

A proactive approach keeps you informed while allowing the experts the space they need to work independently.

Court-Ready Documentation and Testimony

If your situation involves litigation or possible legal action, forensic accountants prepare reports designed for court or regulatory review. This includes:

- Summaries that withstand cross-examination.

- Backup documentation for every conclusion.

- Readiness to serve as expert witnesses if the process goes to trial or arbitration.

Their attention to detail gives you confidence if your dispute escalates or you need to defend your findings.

For more signals that you might need expert help, see these practical signs you need a forensic accountant.

Confidentiality and Professional Ethics

Throughout your engagement, expect the highest standards of confidentiality and ethics. Forensic accounting services are designed to protect your data and your reputation. Every team member is trained to handle sensitive financial records discreetly.

This professional approach makes all the difference when trust is on the line.

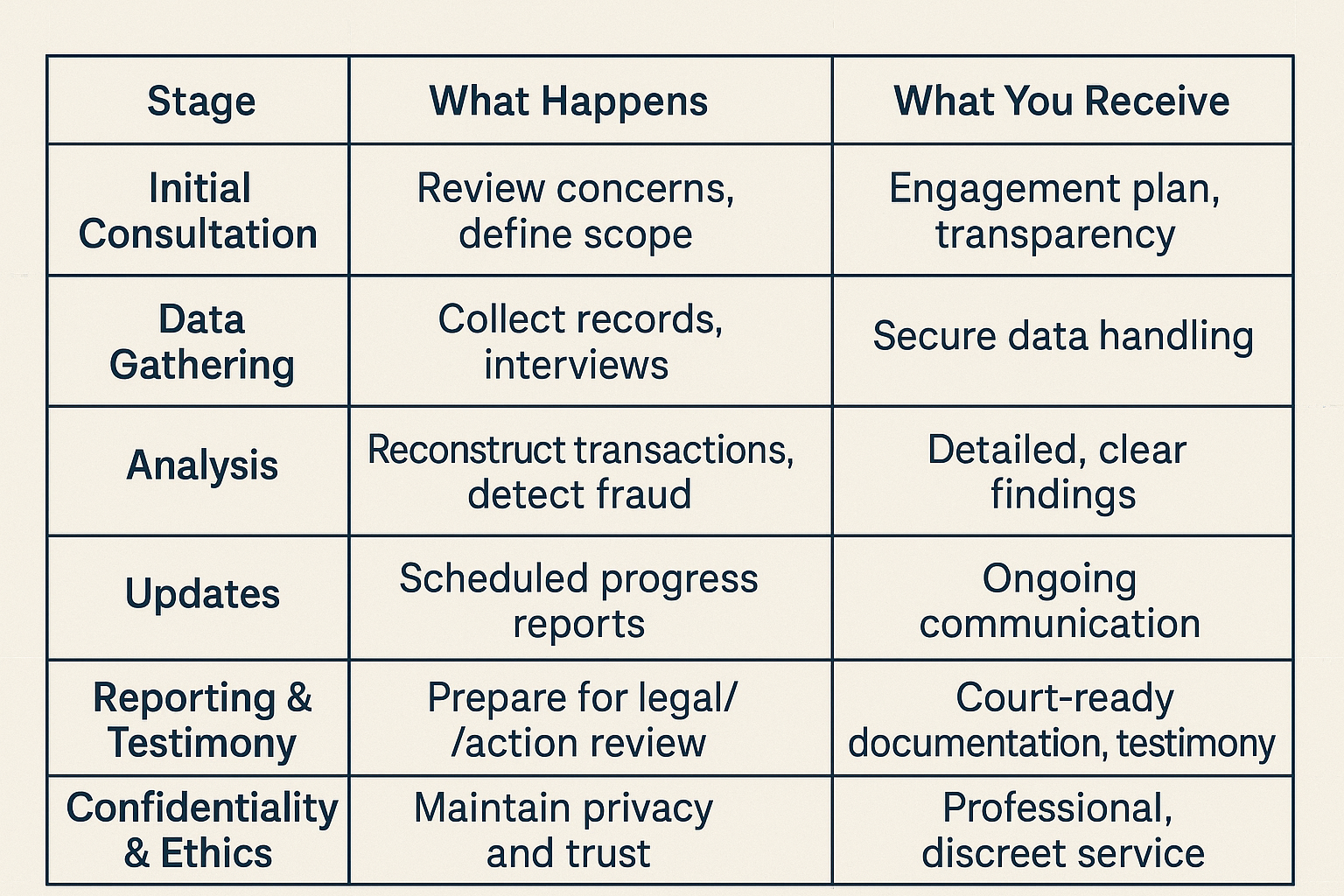

Summary Table: What to Expect at Each Stage

To help you visualize the process, here’s a quick reference table:

To take the first step toward clarity and financial peace of mind, call us or fill out our form for a forensic consultation.

If you are looking for continued financial oversight after a forensic investigation, explore greater control with our outsourced controller services.

Why Choose Turning Numbers for Forensic Accounting

Choosing the right partner for forensic accounting services means trusting someone with your most sensitive financial questions. At Turning Numbers, every case is handled with the highest level of care, accuracy, and commitment to your organization's interests. Here’s how our experience, personalized approach, and focused expertise set us apart.

Deep Expertise Across Many Industries

Turning Numbers brings over 15 years of experience to every client engagement. Our professionals have managed forensic accounting projects for legal, manufacturing, nonprofit, healthcare, and government organizations. Each industry has unique risks, regulations, and types of financial misconduct.

Some ways our expertise benefits you:

- Fast, accurate identification of fraud across varied business environments

- Deep knowledge of regulatory and legal standards for handling evidence

- Solid track record with more than $10 million in funds recovered

With this broad perspective, we adapt proven investigation techniques and reporting styles to fit your needs. This focus ensures you get reports and findings tailored to your context, not just a generic template.

For an overview of our story and client impact, see our company background.

Relentless Commitment to Facts and Integrity

When you partner with Turning Numbers, you work with a team driven by facts, not assumptions. Our investigations always prioritize objective analysis, thorough documentation, and transparent communication. This means you can trust the findings and use them with confidence, whether you’re pursuing legal action or resolving a dispute internally.

Our services are trusted by law firms, insurance companies, and businesses facing lawsuits or regulatory reviews. We build every report to hold up to the highest scrutiny, from boardrooms to courtrooms. For more on the depth of our work in legal settings, review our Legal and Litigation Services.

Comprehensive, Personalized Service

No two cases are alike. Turning Numbers listens to your goals and concerns before starting any investigation. We structure each engagement according to your needs, timelines, and desired outcomes.

What sets our approach apart:

- Initial strategy sessions to pinpoint the scope and facts most critical to your success

- Hands-on guidance through each stage, from investigation to reporting

- Ongoing communication so no question is left unanswered

Our team works quietly behind the scenes to let you focus on leadership and decision-making, not data or paperwork.

Strong Partnerships With Law Enforcement and Legal Teams

Forensic accounting services often require more than just looking at spreadsheets. Our team is experienced in collaborating with attorneys, police, and regulatory bodies when cases demand outside review or potential prosecution.

When there’s a need to work alongside law enforcement, we follow strict protocols for evidence collection and secure handling of sensitive materials. To see an example of how these relationships yield results, visit our post on Forensic Accountants Collaborating with Law Enforcement.

Proven Results and Client Confidence

Turning Numbers is proud to have helped over 200 clients find answers, recover losses, and restore financial order. Our high client retention comes from this history of delivering clear, reliable outcomes in high-pressure moments.

Here’s a quick look at what you gain when you choose us:

- Industry-specific knowledge and real-world experience

- Truthful, court-ready reporting

- Support from initial consult to final outcome

Whether you are facing internal fraud, a partner dispute, or an external investigation, we protect your interests and keep your data safe every step of the way.

If you’re facing a financial question or urgent situation, don’t wait for problems to grow. Call us or fill out our form today for a confidential forensic consultation.

Conclusion

Forensic accounting services do more than protect against fraud, they support growth and strengthen trust in your organization. The right expertise brings confidence in moments of uncertainty, clearing up complex situations and safeguarding your financial standing.

Turning Numbers stands out as a reliable partner, backed by years of proven results across industries. From resolving specific disputes to ongoing support, our team works with focus and care, helping you move forward with certainty.

If you want deeper insight into the hands-on impact of forensic accounting, visit our article on Forensic Accounting on U.S. Tariffs.

Face financial questions with clarity and reassurance—call us or fill out our form today for a confidential forensic consultation.