Fraud Detection and Prevention: Protecting Your Organization from Financial Risks

Every year, organizations lose billions to fraud that often goes undetected until it's too late. Fraud detection and prevention are at the heart of financial stability, especially for organizations seeking forensic accounting services. Financial losses can damage your reputation, drain your resources, and leave lasting effects on your operations.

Hiring expert support isn't just smart, it helps protect what you've built. Our team combines years of experience with proven methods to spot risks early and keep your assets secure. If you're ready to take action against fraud, call us or fill out the form for a forensic consultation. For more in-depth strategies, explore our Fraud Detection and Prevention Services designed for organizations like yours.

Common Types of Fraud Impacting Organizations

Fraud detection and prevention start with knowing which fraud schemes most often strike organizations. Fraud isn't a single issue—it takes many forms, each targeting weaknesses in systems, processes, or trust. Leaders who recognize the risks can respond faster, strengthen controls, and protect their financial health before issues get out of control.

Asset Misappropriation

Asset misappropriation is the most common type of fraud affecting organizations of all sizes. Employees or outsiders steal or misuse company assets, most often cash or inventory. Common examples include:

- Skimming (taking cash before it is recorded)

- Submitting fake invoices or expenses

- Stealing inventory or supplies

These schemes may seem small at first but often result in significant losses over time. Smaller businesses and nonprofits can be hit especially hard, as they may lack formal controls that larger organizations use. For a more detailed breakdown of these schemes, visit this practical resource on types of financial fraud.

Corruption

Corruption involves an insider using their influence for personal gain, often at the organization's expense. It is less visible than outright theft but can cause even greater damage to financial integrity. This includes:

- Bribery, kickbacks, and conflicts of interest

- Undisclosed relationships with vendors or suppliers

- Manipulating contracts for personal benefit

Corruption not only wastes resources but also creates a culture where rules are ignored and risks are hidden. For real-world stories of how corruption has affected nonprofits, see our post on the effect of fraud on nonprofit organizations.

Financial Statement Fraud

Financial statement fraud happens when employees, managers, or executives intentionally falsify accounting or financial records. Motivations include meeting investor expectations, securing loans, or covering up other fraud. Typical examples include:

- Inflating revenue or understating expenses

- Manipulating asset valuations

- Hiding liabilities or shifting losses

This type of fraud can remain undetected for years. When discovered, it harms trust from stakeholders, investors, and regulators, sometimes leading to legal or criminal penalties. Companies committed to robust internal controls and regular audits can stop these schemes before they start. For further reading, the FAU College of Business highlights these categories in its overview on occupation fraud.

Expense Reimbursement Fraud

Expense reimbursement schemes might appear trivial, but they add up quickly. Employees submit fake or inflated expenses for reimbursement, such as:

- Double-billing for business travel

- Submitting receipts for personal purchases

- Claiming expenses that never occurred

Without strict oversight, businesses can lose thousands to these “petty” frauds each year.

Payroll Fraud

Payroll fraud includes altering timesheets, adding fake employees (ghost employees) to the payroll, or granting unauthorized raises. It’s common in organizations with weak payroll controls and little oversight. Some common types of payroll fraud are:

- Falsifying work hours

- Paying for work not performed

- Creating ghost employees

Stable processes and regular audits are the best tools to prevent payroll abuse.

Cyber and Digital Fraud

Digital fraud keeps rising as organizations go online. Phishing scams, ransomware, and data breaches lead to unauthorized transfers, stolen information, and lost funds. Common methods of cyber fraud include:

- Email phishing requests for wire transfers

- Malware that harvests login credentials

- Invoice manipulation through hacked email accounts

Criminals often prey on human error, not just technical weaknesses. Ongoing training and strong cyber hygiene are essential for fraud detection and prevention in this area.

Every organization faces threats from more than one kind of fraud. Recognizing the red flags and building internal systems to counter each type can help you keep risks manageable and avoid major financial setbacks.

Key Strategies for Fraud Detection and Prevention

Fraud detection and prevention require more than just good intentions—you need a thoughtful plan and real action. A comprehensive approach blends people, processes, and technology to minimize risks and catch fraud before losses spiral. When organizations bring together solid controls and smart technology, they build stronger financial defenses.

Role of Internal Controls

Photo by Alex P

Photo by Alex P

Internal controls act as the locks, alarms, and cameras of any good accounting process. They make it harder for fraud to take root—and much easier to spot tiny problems before they turn into disasters. A few well-chosen procedures carry major weight in fraud detection and prevention.

In daily operations, these controls include:

- Segregation of Duties: No single person should handle every step of a financial transaction. When tasks are split (like authorizing payments, writing checks, and reconciling accounts), it limits opportunities for wrongdoing.

- Access Restrictions: Strictly limit who can see and touch sensitive data. Give access only to employees who need it for their job. Use unique logins and change credentials when someone leaves.

- Transaction Monitoring: Watch accounts for odd or unexpected activity. Regular reviews catch outliers, unauthorized transfers, or sudden spending spikes.

- Documented Processes: Write down procedures. When everyone follows the same playbook, it’s much easier to spot gaps or signs that something isn’t right.

You can read a detailed breakdown of these controls and why they work in the Importance of Internal Controls in Preventing Fraud.

To keep controls strong:

- Review and update policies each year.

- Train staff on warning signs and response plans.

- Check compliance with internal and external audits.

By making internal controls a daily habit, organizations create a workplace where fraud has fewer places to hide. For an in-depth look at how strong financial systems can support broader governance, check our resource on Forensic Accounting and Corporate Governance.

Fraud Detection Tools and Technology

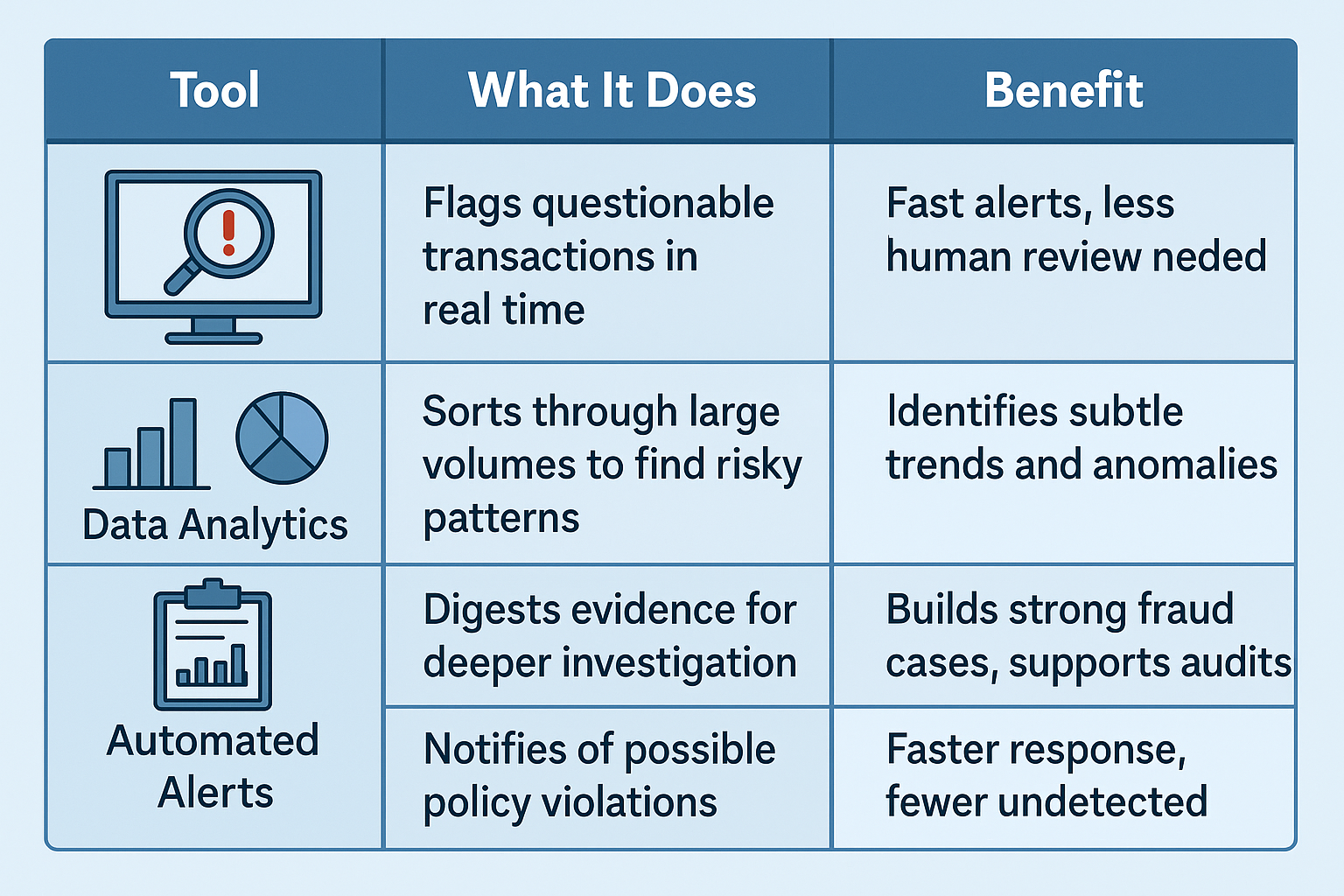

Today’s fraudsters are crafty, but technology is catching up. Specialized software and forensic accounting tools shine a light on patterns that humans often miss, speeding up both detection and response. They're essential for modern fraud detection and prevention.

Key tools and tech in the fight include:

- Fraud Detection Software: Programs analyze banking, payment, and expense data in real time. They use rules and patterns to flag suspicious transactions. If an employee submits expenses outside of normal hours or above expected ranges, the system can send an alert right away.

- Data Analytics: Large data sets hide clues. Analytical platforms comb through thousands of records, identifying trends, anomalies, or outliers. These tools spot what would otherwise seem like harmless errors in a mountain of paperwork.

- Forensic Accounting Techniques: Trained forensic accountants use a mix of manual reviews and software to dig deeper. They reconstruct timelines, follow money trails, and pinpoint where controls failed.

- Automated Monitoring: With increasing access to cloud-based systems, organizations now receive instant notifications for activities that break set rules, significantly reducing detection time.

Here’s a quick table outlining the primary technologies:

Keeping up with advancements matters. For insights into where forensic accounting is heading and the latest tech innovations, review the section on Future trends in forensic accounting.

While technology is a crucial partner, people still make the final call. Employee training and clear anti-fraud policies work hand in hand with these tools. For organizations ready to take action, our guide to building effective fraud prevention helps set a solid foundation for both culture and control.

Keeping your business safe calls for vigilance and smart investment in both proven processes and technology. If you want to strengthen your fraud detection and prevention program, call us or fill out the form for a forensic consultation.

How Forensic Accountants Support Fraud Prevention

Fraud detection and prevention rely on more than catching issues after the fact. Forensic accountants help organizations stay ahead of schemes through careful review, effective investigations, and constant focus on improvement. Their skill set goes beyond the numbers—they dig into suspicious activity, document the facts, and create a safer environment for financial integrity. Here's how these professionals strengthen your financial defenses.

Investigations and Evidence Gathering

Photo by Leeloo The First

Photo by Leeloo The First

When organizations spot red flags, forensic accountants move quickly to investigate. They don’t just look at surface details—they trace all relevant transactions, review supporting documents, and verify records with a trained eye for hidden patterns.

Forensic accountants excel at:

- Tracing suspicious transactions: Following the money trails and mapping out where assets have gone.

- Interviewing witnesses and staff: Asking the right questions to spot inconsistencies and gaps in stories.

- Collecting supporting documents: Gathering key invoices, receipts, electronic records, and communications.

- Analyzing financial statements: Pinpointing gaps or irregularities that signal fraud.

Everything is documented in a clear, defensible way. This evidence often provides the backbone for legal proceedings, regulatory actions, or internal recovery efforts. When disputes do reach court, detailed forensic reports and expert testimony can make or break a case. The support doesn’t stop there—these experts assist management and legal teams, helping them understand the facts so decisions aren’t made in the dark.

For a deeper look at how external support can strengthen investigations, review the article on the role of litigation support in fraud investigations. Their involvement brings structure, technology, and a disciplined approach that translates financial chaos into clear evidence.

Ongoing Risk Assessments and Controls Improvement

Rather than waiting for a crisis, forensic accountants offer routine assessments to test the strength of your controls. They step into the “shoes” of a would-be fraudster, identifying weak spots and suggesting improvements to block their path.

Key activities include:

- Periodic risk assessments: These reviews look at current procedures, recent incidents, and any changes in business that could expose new risks.

- Control testing: Evaluating the actual way policies play out day-to-day, not just how they’re written.

- Staff education: Training your team to spot behavioral red flags and respond to unusual activity. Group sessions and scenario-based workshops help make anti-fraud efforts part of the everyday routine.

- Updates for changing threats: As fraud schemes change, accountants help refresh policies and boost technical defenses.

These steps not only reduce risk—they build a culture that rejects fraud at every level. Employees who know the warning signs and understand how to act become an active force for fraud detection and prevention. To find tips for boosting your prevention strategies, visit this page focused on Behavioral Red Flags for Fraud Prevention.

Regular reviews, honest feedback, and continuous training put power in your hands to protect your business. Forensic accountants give you confidence—not just that fraud will be found, but that it’s less likely to happen in the first place.

Conclusion

Ongoing fraud detection and prevention keep your organization prepared and resilient against costly risks. Consistent monitoring, strong controls, and early action are the best ways to protect your financial health and reputation.

The right support can make a difference. Turning Numbers has the experience and tools to help you reduce risk, respond quickly to warning signs, and build trusted systems. Effective prevention also includes steps like employee fraud training programs that empower your whole team to spot and stop fraud before it takes hold.

Reach out today to strengthen your fraud detection and prevention plan. Call us or fill out the form for a forensic consultation. Your organization’s security is worth it.