Fractional CFO Forensic Accounting Services 2025 | Trusted Strategic Financial Guidance

Every organization faces times when it needs expert financial direction but can't justify the expense of a full-time CFO. A fractional CFO steps in as a trusted resource, offering executive-level financial guidance with the flexibility and cost savings business leaders want. This approach, now popular across many industries, is especially valuable for those who also require targeted forensic accounting to manage risk, detect fraud or investigate financial matters.

With experienced support from specialists like Turning Numbers, organizations can gain clear financial insights while also securing confidence in their records and transactions. If your business is pursuing clarity and protection, now's the time to reach out for a forensic consultation. Call us or fill out our easy contact form to get started today—or learn more about the benefits of Hire Fractional CFO Services for your organization.

What is a Fractional CFO and Who Needs One?

Photo by Alena Darmel

Photo by Alena Darmel

A fractional CFO is a seasoned financial executive who joins an organization on a part-time or contract basis. Businesses bring in these professionals to get executive-level financial advice, oversight, and strategy—without needing to commit to the salary and benefits of a full-time hire. This model is especially practical for organizations with complex financial needs but limited resources. Fractional CFOs step in when you need more than what a bookkeeper, controller, or general accountant can provide.

Defining a Fractional CFO

A fractional CFO provides everything you’d expect from a traditional chief financial officer, only on a flexible schedule that fits your organization’s size and budget. They offer high-level skills in:

- Financial planning and forecasting

- Risk management

- Cash flow optimization

- Reporting and compliance

- Strategic decision support

Unlike consultants who focus on short-term fixes, a fractional CFO becomes part of your team. They bring consistent oversight, help set financial direction, and offer unbiased insights during critical business decisions. Learn how a fractional CFO can help protect against fraud and reporting errors by reviewing our Forensic Accounting Services.

Who Needs a Fractional CFO?

Small and mid-sized organizations benefit the most from fractional CFO support, but any business facing complex financial management can gain value.

Here are the most common situations where hiring a fractional CFO makes sense:

- Growing companies experiencing rapid expansion or looking to raise capital

- Startups needing financial systems but not ready for full-time leadership

- Established businesses tackling a challenging acquisition, audit, or restructuring

- Organizations with limited internal controls or facing increased financial scrutiny

- Businesses in highly regulated industries, like healthcare, construction, or financial services

Startups especially can sidestep costly mistakes by engaging a fractional CFO early, as outlined in 7 Reasons Every Startup Needs a Fractional CFO from Day One.

Fractional CFOs are trusted by business owners, boards, and legal teams who need reliable financial clarity, personalized advice, and expert fraud detection—all on an adaptable schedule.

When Fractional CFOs Bring Their Greatest Value

Consider the impact when your organization needs:

- Forensic investigation of suspected fraud or misreporting

- Help refining financial forecasts, budgets, or investment plans

- Guidance handling cash flow crunches

- Strategy support before mergers, acquisitions, or major contracts

If you’re facing complex financial questions or want stronger safeguards, a fractional CFO bridges the gap between hands-on accounting and executive vision. For further detail on how these experts help law enforcement and protect your organization from financial crime, take a look at Forensic Accountants Collaborating with Law Enforcement.

Fractional CFOs tailor their support to your business’s stage, challenges, and goals, making them a smart solution for organizations seeking trusted financial leadership without overcommitting resources.

Key Benefits of Hiring a Fractional CFO for Forensic Accounting

Securing your financial future goes beyond basic bookkeeping. If your organization faces fraud risks, lawsuits, or just wants assurance over its financial records, a fractional CFO with forensic accounting experience offers a precise and proactive solution. This unique hybrid gives you the peace of mind of executive oversight, but on terms that work for your bottom line. Let’s break down how hiring a fractional CFO can transform your approach to financial investigation and risk management.

Photo by Mikhail Nilov

Photo by Mikhail Nilov

Specialized Fraud Detection and Prevention

A fractional CFO brings a detective’s mindset to your books. With forensic accounting experience, these professionals can:

- Spot unusual patterns or red flags quickly, thanks to years of specialized training.

- Identify gaps in your internal controls before they are exploited.

- Conduct thorough financial reviews to detect potential embezzlement, misstatement, or unauthorized transactions.

This means your business isn’t just reacting to fraud. You’re putting up strong defenses, deterring threats before they snowball into real damage. The result? Cleaner books, less stress, and more time to focus on your business goals.

Clear, Unbiased Financial Investigations

Whether you’re facing an investigation, legal dispute, or need a second look at historical transactions, a fractional CFO offers an objective perspective. Unlike internal staff, they are removed from daily operations and internal politics. This allows them to:

- Provide independent findings you can trust in court, with law enforcement, or for insurance claims.

- Prepare detailed reports that are easy to understand and stand up to scrutiny.

- Serve as expert witnesses if cases proceed to litigation.

If you’re interested in even more detail on how fractional CFOs contribute to fraud risk reduction and transparency, the whitepaper from OTC outlines several prime benefits of a fractional CFO for financial planning and fraud prevention.

Cost-Effective Expertise

Full-time CFOs are expensive—especially for growing organizations or those facing temporary financial reviews. Fractional CFO services are different:

- You get top-tier expertise only when you need it, saving on salary and benefits.

- Access to forensic analysis, without paying for a full internal audit team.

- Flexible contracts mean no long-term commitment.

This cost structure brings financial leadership within reach for mid-sized groups, nonprofits, and even fast-growth startups. You control the engagement, the hours, and the outcomes.

Strategic Risk Management

Forensic accountants work to safeguard your organization from financial risk, but a fractional CFO brings additional layers of strategy:

- They conduct risk assessments, evaluating everything from fraud potential to compliance hurdles.

- Best practice recommendations help tighten internal processes, so your risk profile improves for the long haul.

- Timely reporting and actionable insights put you in a stronger position to react to threats or regulatory scrutiny.

If you’re ready to go beyond simple “oversight” and want an active partner in risk management, fractional CFO support is a direct answer.

Enhanced Cash Flow and Resource Allocation

Investigating fraudulent or mismanaged funds often reveals bigger issues with financial planning or resource allocation. Fractional CFOs don’t stop at uncovering problems; they help design solutions:

- Restructure processes to ensure company funds are protected and well-spent.

- Recommend optimized cash controls and transparent expense reporting.

- Forecast future needs based on present findings, aligning budgets and resources.

As outlined by Barnes Dennig, these professionals are skilled in managing cash flows and mitigating liquidity risks , making them valuable resources for keeping your operations smooth and compliant.

Rapid Response to Emerging Issues

When fraud or financial irregularities surface, time is critical. Fractional CFOs are used to jumping in quickly:

- They ramp up investigations without the onboarding delays of new, full-time hires.

- Their contracts are scalable, so you get more (or less) support as the situation demands.

- They use advanced forensic technology, expediting the review and recovery process.

This speed ensures your leadership team gets answers before damage can spiral.

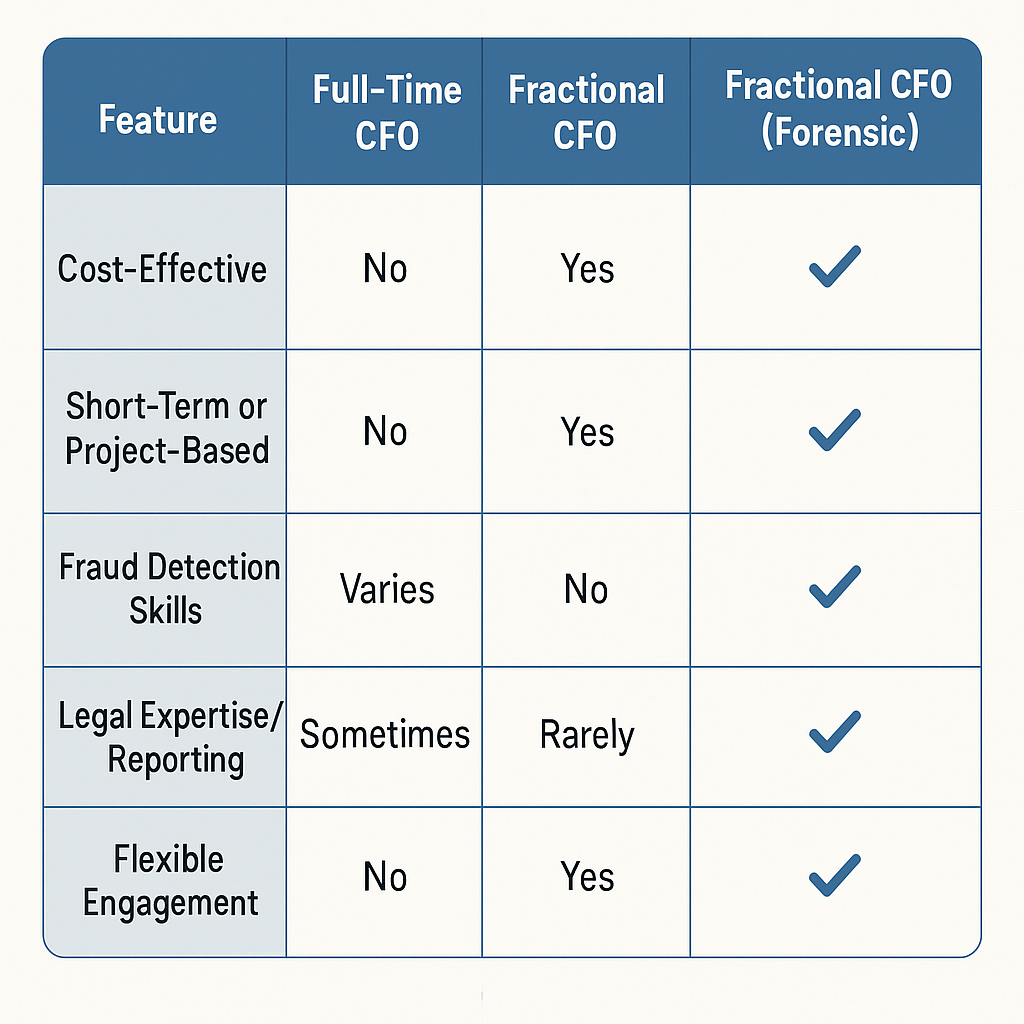

Table: Key Features and Benefits

Here’s a quick summary of how a fractional CFO with forensic accounting experience stands out:

A fractional CFO with forensic knowledge safeguards your business’s future. They bring precise expertise, risk insights, and financial clarity without weighing down your budget. If you’re ready for focused support, call or fill out the form for a forensic consultation and protect your organization’s finances with confidence.

How to Choose the Right Fractional CFO for Your Organization

Selecting a fractional CFO is a key decision that influences your organization’s financial stability and future growth. The right candidate delivers more than oversight; they become an extension of your leadership team, offering guidance when it matters most. Whether your business needs forensic expertise, growth support, or a financial strategy overhaul, careful selection ensures your goals are met and risks are minimized.

Photo by RDNE Stock project

Photo by RDNE Stock project

Assess Your Organization’s Needs

Before starting your search, take stock of your organization’s financial structure and challenges. Do you need advanced forensic accounting, fraud prevention, audit support, or strategic planning? Pinpoint these needs first.

- Forensic accounting support for fraud detection or risk management.

- Financial planning and forecasting to steer your organization’s growth.

- Help with audits, compliance, or navigating legal challenges.

- Oversight for mergers, acquisitions, or large transactions.

Clearly defining your priorities will help you find a fractional CFO whose skills match your objectives.

Evaluate Experience and Credentials

Experience matters when it comes to trusted financial leadership. Look for a candidate with a track record of working in roles similar to your needs. Focus on:

- Industry experience : Have they worked with businesses like yours? Specialized knowledge can make a difference, especially in regulated fields.

- Certifications : Credentials such as CPA (Certified Public Accountant) or CFE (Certified Fraud Examiner) reflect commitment to high standards.

- References : Speak to former clients, particularly those who needed forensic analysis or risk management.

A strong About Turning Numbers page gives insight into team experience and can help you compare expertise.

Consider Cultural Fit and Communication

A fractional CFO will interact with your team, speak with outside auditors or attorneys, and handle sensitive information. They need to fit seamlessly into your company culture and communicate clearly at every level.

Look for someone who:

- Explains complex financial issues in plain language.

- Earns trust quickly and maintains transparency.

- Understands the unique pressures and personalities within your organization.

Personal fit is just as important as technical skill. You want a partner your team respects and listens to.

Compare Cost, Flexibility, and Engagement Model

Fractional CFO services come in different models. Some offer project-based work, while others support your company for a set number of hours each month. Concentrate on finding a solution that aligns with your budget and schedule.

Key factors to compare:

Understanding these elements will help you avoid surprises and make sure the service fits your organization.

Identify Advanced Skills for Forensic Accounting

Not all fractional CFOs have forensic expertise. If your organization needs fraud detection or investigative analysis, confirm candidates have the right skills. Look for:

- Experience in uncovering fraud, misconduct, or internal control weaknesses.

- Comfort working with attorneys, insurers, and law enforcement.

- Ability to create detailed, defensible reports for legal or regulatory review.

This specialized knowledge is the difference between a generalist and a true forensic partner. The experts at Turning Numbers, for example, have a long-standing reputation for empowering businesses with clear, defensible insights.

Check Their Problem-Solving and Technology Approach

The best fractional CFOs combine practical tactics with advanced technology. Modern analytical tools and data platforms offer new ways to spot trends, errors, or risks quickly.

Ask candidates about:

- Their approach to technology and analytics in financial investigations.

- The systems or platforms they recommend for reporting and compliance.

- Examples of past solutions to complex or urgent financial challenges.

Proven problem-solvers who embrace the right tools will make your financial oversight more secure and efficient.

Ask About Past Outcomes and Case Studies

Request specific examples or case studies where the fractional CFO delivered results in situations similar to yours. Did they help recover lost funds, improve controls, or streamline reporting? Stories with measurable impacts add confidence.

For more on what separates top-tier fractional leaders, review this helpful guide to choosing a fractional CFO or Controller that matches your business’s needs.

Next Steps

Choosing the right fractional CFO sets a foundation for safer, more confident financial operations. If you’re ready to start the selection process, call or fill out our form to schedule a forensic consultation and take the next step in protecting your organization’s future.

Conclusion

A fractional CFO offers more than financial oversight, serving as a trusted guide for organizations that want both confidence and clarity in their records. With the added skill of forensic accounting, these experts help businesses uncover the truth, detect fraud, and ensure money is managed with care.

Choosing a fractional CFO brings targeted insight without the cost of a full-time hire. At Turning Numbers, the focus stays on protecting clients’ interests while delivering strategic guidance that stands up in complex situations. Organizations that value transparency, accountability, and robust financial defenses benefit most from this flexible approach.

Turn your concern into reassurance. Call Turning Numbers or fill out the online form for a complimentary forensic consultation. Take the first step toward financial clarity and peace of mind. For other perspectives and deeper insights on fraud detection, visit the Turning Numbers Blog Home.