Outsourced Controller: Forensic Accounting & Fraud Prevention | 2025

Many organizations need expert financial oversight but can't justify hiring a full-time Controller. Outsourced controller services fill that gap by giving businesses access to seasoned financial professionals who bring structure, transparency, and accountability. These services are ideal for companies aiming to strengthen internal controls, improve financial reporting, and handle complex issues like fraud or disputes.

For organizations worried about fraud prevention and clear financial records, the right oversight isn't just helpful, it's essential. Outsourced controller solutions not only support the day-to-day accounting but add another layer of security and trust, especially during periods of change or uncertainty.

If your organization needs reliable financial controls or help with investigating irregularities, take action now. Call us or fill out the form to request a forensic consultation and learn how you can protect your assets and resolve concerns with confidence.

What Is an Outsourced Controller?

For organizations seeking strong financial oversight without hiring a full-time finance executive, an outsourced controller can be the solution. This financial expert steps in as a fractional leader, bringing a wealth of knowledge and a watchful eye to your organization’s accounting and reporting processes. Think of an outsourced controller as the financial backbone for companies that want trust and precision in their operations without long-term payroll commitments.

Photo by Mikhail Nilov

Core Responsibilities of an Outsourced Controller

An outsourced controller provides a flexible way for businesses to tap into financial expertise. These professionals handle tasks that go far beyond bookkeeping. Key responsibilities include:

- Oversight of daily financial operations: They supervise bookkeeping, payroll, accounts payable, and accounts receivable.

- Monthly and quarterly financial reporting: The controller ensures your financial statements are complete, accurate, and ready for decision making.

- Internal controls and fraud prevention: By establishing strong processes, controllers help prevent fraud and protect assets.

- Policy and procedure development: They design processes to make sure accounting practices are consistent and clear.

- Preparation for audits and regulatory reviews: Controllers make sure your records are in order, reducing anxiety and risk during financial reviews.

For a detailed review of what these duties can look like, check out this useful guide: What is an Outsourced Controller and What Do They Do?

Why Organizations Hire Outsourced Controllers

Businesses turn to outsourced controllers for reasons that range from cost savings to improved trust in reporting. Some of the main motivations include:

- Cost efficiency: You get top-tier expertise without the cost of a full-time executive salary.

- Access to unbiased expertise: External controllers offer a fresh perspective and no internal bias.

- Scalable support: Companies can adjust the level of support based on business complexity or growth.

- Improved accountability: Regular oversight means financial issues are caught and addressed quickly.

- Better fraud detection: With dedicated oversight, your business reduces the risk of financial misconduct.

For an overview of professional solutions in this field, see the Outsourced Controller Services Overview.

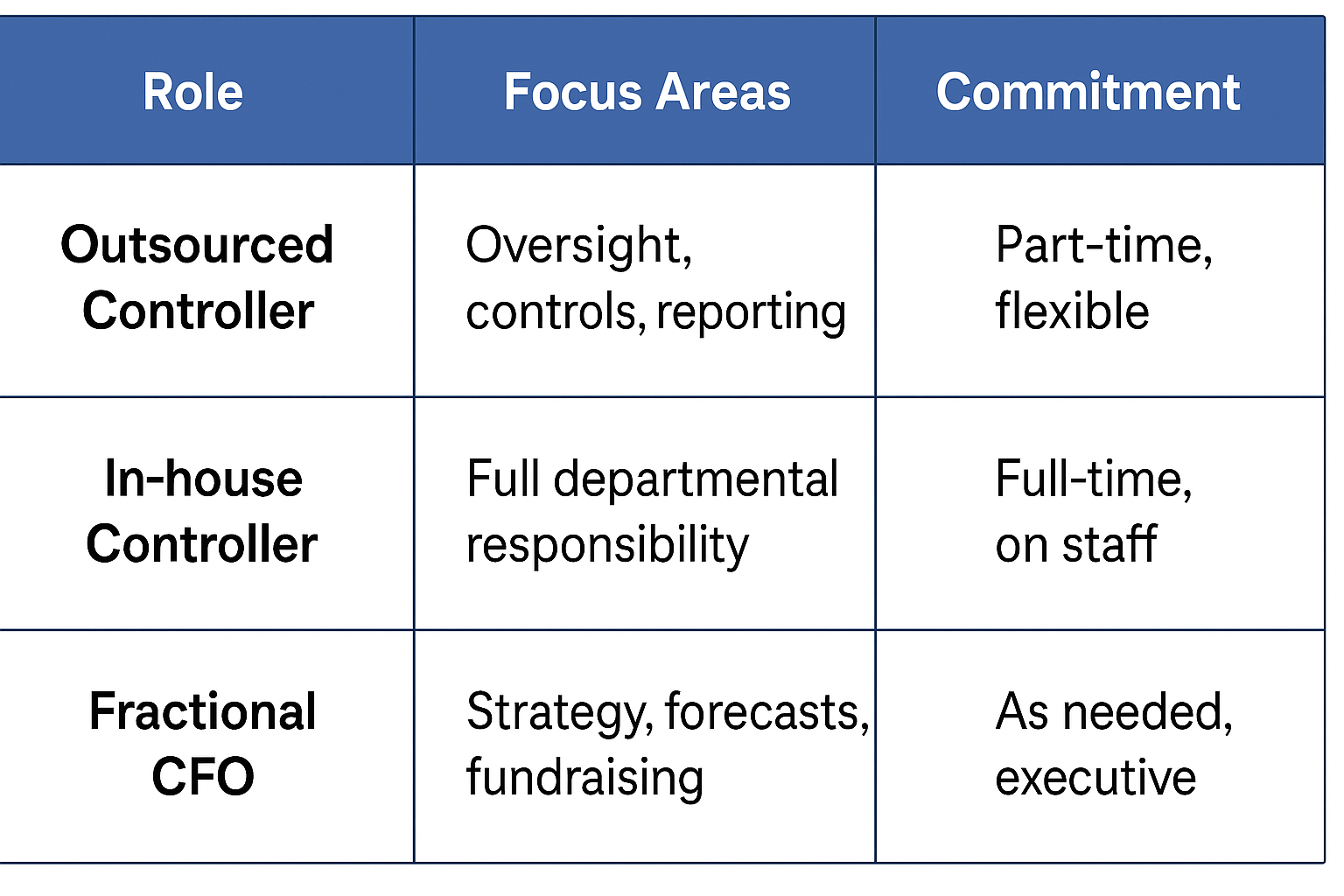

How an Outsourced Controller Differs from Traditional Roles

It’s helpful to know how this role fits into the bigger financial picture. Unlike a full-time Chief Financial Officer (CFO) or an in-house controller, an outsourced controller offers:

This flexibility means organizations can bring trusted insight into financial operations without disrupting workflows.

The Value for Forensic Accounting and Internal Controls

For those concerned about fraud, an outsourced controller is more than a number cruncher. They play a significant role in boosting internal controls, identifying red flags, and ensuring financial transparency. Their presence helps close the gaps that fraudsters often exploit, giving organizations peace of mind in both stable and turbulent times.

For more information on protecting your business from fraud, explore our article on Understanding Financial Statement Fraud Explained.

Outsourced controllers offer practical benefits and strong financial foundations, making them vital for businesses who need flexibility, trust, and high-level oversight, especially when internal resources are stretched.

Key Benefits of Outsourcing Controller Services

Outsourced controller services offer a powerful solution for organizations seeking financial clarity and accountability without hiring a full-time CFO. These services deliver more than monthly reports—they safeguard your organization with practical risk management, active fraud prevention, and skillful adaptation to business changes. By handing control to experienced professionals, companies can focus more on growth and less on uncertainty.

Financial Oversight and Risk Reduction

An outsourced controller takes the driver’s seat in protecting your business finances. These professionals use forensic principles and industry best practices to tighten controls and spot weak points before issues arise. They structure accounting workflows to reduce the risk of costly errors, policy gaps, or financial misstatements.

By regularly reviewing transactions, reconciling accounts, and enforcing segregation of duties, an outsourced controller can catch signs of fraud or mistakes that might slip past basic bookkeeping. Their approach is supported by strong risk management strategies, such as:

- Using advanced data analytics to scan for unusual patterns

- Implementing regular financial and operational audits

- Monitoring compliance with internal policies and external regulations

Want to learn more about the strategies that protect organizations? Explore these insights on financial risk management and best practices for a deeper understanding.

Fraud Prevention and Detection Support

Specialized fraud prevention is a hallmark benefit of outsourcing your controller role. These experts design controls and checks that protect your organization’s most vulnerable areas, responding quickly to any signs of trouble.

Key ways outsourced controllers support fraud prevention and detection include:

- Setting up robust approval processes

- Implementing regular checks for duplicate or suspicious transactions

- Staying alert to changes in vendor payments and payroll patterns

- Creating a clear audit trail for all financial transactions

For many organizations, pairing outsourced controller services with dedicated solutions further boosts their fraud defenses. If you want support that zeroes in on fraud protection, check out the Fraud Detection and Prevention service, which works hand-in-hand with controller oversight.

Scalable Expertise for Growing Organizations

Every business faces forks in the road—new regulations, rapid growth, audits, or even litigation. Outsourced controllers adapt quickly to your needs, matching their involvement to your business’s stage and complexity. Whether you’re expanding your team or facing an unexpected audit, scalable controller support brings experience and calm to each new challenge.

Some key advantages delivered through this adaptive support:

- Flexible engagement: Increase or decrease service as business needs shift

- Specialty skills on demand: Tap into niche expertise for audits, mergers, or investigations

- Consistent compliance: Stay up-to-date with evolving financial rules and reporting standards

A skilled outsourced controller transforms complexity into clarity, giving you confidence to move forward—whether you’re adding new locations or dealing with regulatory reviews. If your organization is preparing for what's next, controller services provide a steady hand to guide the way.

If you have questions about how your business can benefit from these capabilities, call us or fill out the form to request a forensic consultation.

When Does an Organization Need an Outsourced Controller?

Choosing the right moment to bring in an outsourced controller can transform how an organization handles its finances, especially when resources stretch thin or expertise is missing in-house. Recognizing the signs early can be the difference between financial clarity and prolonged uncertainty. This section will outline common situations when an outsourced controller makes sense, providing guidance for leaders deciding if now is the right time.

Limited Internal Resources

A small finance team or limited expertise often means important financial details go unchecked. When one person juggles bookkeeping, reporting, and internal controls, errors and fraud risks climb. If your organization relies on staff without deep financial backgrounds, outsourcing controller tasks ensures the books stay accurate and no red flags are missed.

Key warning signs include:

- Overworked finance staff

- Missed deadlines for monthly or quarterly closes

- Gaps in documentation or approval processes

- Difficulty producing reports for audits or board meetings

Outsourced controllers can step in immediately, filling skills gaps with minimal training and quickly bringing order to chaos.

Rapid Growth or Change

Growth is exciting, but it often uncovers processes that don’t scale. Expanding operations, mergers, or new service lines introduce complexity and create pressure on existing controls. If the current finance team gets overwhelmed or new business models add confusion, it’s time to consider outside expertise.

Common triggers include:

- Acquisitions or geographic expansion

- Funding rounds or outside investments

- Implementation of new accounting software

- Organizational restructuring

Controllers experienced in transitions can redesign workflows, train teams, and keep finances running smoothly during periods of change.

Suspicions of Fraud or Financial Irregularities

When signs of fraud or unexplained variances appear, an unbiased perspective is critical for quick investigation and recovery. Many organizations notice missing cash, unexplained expense spikes, or issues with vendor payments before realizing they need specialized help.

An outsourced controller brings immediate fraud awareness. Their work with controls, data review, and separation of duties helps identify where financial irregularities may hide. This urgency is especially true in the nonprofit sector, as described in the Impact of Fraud on Nonprofits , where strong oversight is often the best defense.

Preparing for External Reviews or Litigation

Upcoming audits, regulatory reviews, or business disputes demand financial records that are clean, detailed, and legally defensible. If your finance team can’t dedicate full attention to preparing for these events, consider outsourcing.

Organizations may face:

- Government audits or grant requirements

- Financial statement reviews for investors or partners

- Legal disputes requiring detailed financial disclosure

Controllers with experience in compliance and forensic accounting ensure your records stand up to scrutiny and keep risks in check.

Temporary or Project-Based Financial Support

Not every organization needs a full-time controller year-round. Sometimes, temporary gaps arise—a controller leaves, a major project stretches capacity, or a special investigation ramps up. Outsourcing allows organizations to meet these exact needs for the time required, without taking on permanent staff or lengthy onboarding.

This solution fits:

- Maternity or medical leaves

- Year-end close and tax preparation

- Short-term cleanup of prior period accounting

- Special consulting projects

Hiring on a fractional basis means you pay for the expertise only when you use it, keeping costs under control while maintaining high standards.

When Expert Judgment Makes the Difference

Some situations call for the type of expert judgment only gained through years of financial and forensic experience. Forensic accountants such as Allepichian Aldrich are often brought in when impartial decision-making and investigative skill are needed. Outsourced controllers with this background support organizations by spotting hidden risks, asking the right questions, and providing objective recommendations right when you need them most.

Recognizing these triggers early helps businesses act before small issues become financial crises. If your organization faces any of these signs or isn’t sure what level of oversight you need, take the next step now. Call us or fill out the form to request a forensic consultation and get clarity on your best path forward.

Choosing the Right Outsourced Controller Service

Finding the right outsourced controller is a key decision for any organization aiming to enhance financial oversight, strengthen controls, and protect against risks. With the right fit, you gain more than numbers—you secure experience, trust, and a steady guide through changing business needs. Before making your choice, consider the following critical factors to make the partnership successful.

Photo by Kindel Media

Assess Organizational Needs and Goals

Start by listing the finance challenges you want to solve. Think about gaps in expertise, areas of risk, and upcoming changes such as audits or growth phases. Align these needs with your organization's priorities:

- Improve financial reporting and close processes

- Establish or strengthen fraud prevention controls

- Prepare for audits, grant compliance, or legal reviews

- Support rapid expansion or new lines of business

Make sure you understand whether you need a short-term fix, long-term partnership, or specialized forensic expertise. Outlining your requirements clarifies what to look for and helps you compare providers side by side.

Evaluate Expertise and Industry Experience

Not all controllers bring the same background. Look for proven experience, especially in forensic accounting or your specific industry. A skilled outsourced controller should demonstrate:

- Years of relevant accounting experience

- Certifications (such as CPA or CFE) that fit the work

- History of successful fraud prevention or resolution

- Familiarity with regulatory issues in your sector

If your organization serves healthcare, construction, nonprofits, or other complex sectors, confirm their understanding of relevant compliance rules and risk areas. Reviewing a firm's track record and exploring their company values can help you judge fit and reliability. You can learn more on the About Turning Numbers page to see how specialization brings value.

Check Technology and Reporting Compatibility

Seamless integration is important. The outsourced controller should be comfortable working with your accounting systems and software stack. Ask how they:

- Transfer and secure financial data

- Collaborate remotely—or on-site if needed

- Deliver timely financial reports and dashboards

- Adapt to rapidly changing technology needs

Controllers using up-to-date software often spot discrepancies faster and streamline data sharing, making monthly closes smoother and audits less stressful.

Communication Style and Accessibility

Financial oversight only works if communication is clear and proactive. Choose a service known for quick responses, clear explanations, and an approachable style. Discuss preferred meeting frequency, reporting methods, and how issues are escalated.

A controller should be confident discussing sensitive topics and ready to break down complex financial matters in everyday language. Collaboration is smoother when everyone speaks the same language and expectations are set early.

Understand Service Scope and Flexibility

Outsourced controller services vary from basic compliance checks to hands-on forensic investigation and ongoing strategy. Define your expected level of support:

- Recurring tasks: Account reconciliation, payroll oversight, internal controls

- Strategic projects: Audit prep, fraud investigations, merger support

- Temporary work: Filling gaps during transitions or covering leaves

Ask about flexibility as your needs change—whether you can scale services up or down without hassle. For practical guidance, check out these tips for finding outsourced controller services tailored to your business.

Cost Structure and Value

Budgeting for an outsourced controller is more than comparing hourly rates. Clarify what’s included, how billing works, and whether there are additional fees for rush projects or after-hours support. Value includes not just pricing but also quality, responsiveness, and how well fraud risks are managed.

Here's a quick summary table to help you compare key aspects when evaluating potential providers:

Taking these steps streamlines the process and lowers the risk of miscommunication or hidden surprises. Make sure your outsourced controller does more than fill a gap—look for a partner invested in your long-term financial health. For more context on how outsourced controllers function as a core financial resource, articles like The Outsourced Controller: A Secret Weapon for Financial Stability provide a useful overview.

If you’re ready to take action or want guidance selecting the best solution, call us or fill out the form for a forensic consultation. The right partner could be the difference between guessing and growing with confidence.

Conclusion

Outsourced controller services transform the way organizations manage financial oversight and handle risk. By adding experienced guidance and stricter controls, these services help safeguard assets and reduce the chances of fraud or costly errors. Reliable oversight supports confident decision-making and keeps your organization prepared for anything from audits to sudden changes.

If your business faces complex financial challenges or needs support investigating irregularities, consider reaching out for guidance. Call us or fill out the form for a forensic consultation. For organizations addressing financial misconduct, expand your understanding by exploring Forensic Accounting Services and discover tailored solutions that reinforce confidence and protect your business for the long run.